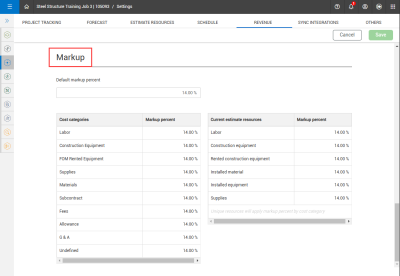

On the Revenue tab, you can configure a default markup percentage that applies the markup to the entire project. The Markup percent table adds a markup per cost category and per resource type on all cost categories in resources in the project.

For example, if you added 10% to Labor resources, then any labor resources automatically have a 10% markup added to it, and that affects the resources charge rate. Then that charge rate affects the amount of revenue that cost items can bill for and earn.

After you set labor at 10% and click Save, you can select from the following options to confirm your change:

| Option | Description |

|---|---|

| Update all existing cost categories and resources in the project | This option adds 10% resource markup percent for all labor resources. |

| Update matching existing cost categories and resources | This option changes the current charge rates only for resources that were not manually modified. Anything that has not been modified such as a labor resource, this option overrides it with 10%. |

| Only apply to cost items and resources created in the future | This option makes no changes to existing resources. Any newly created resources, labor resources in this example, have a 10% markup added to them.maps |

Cost categories are applicable in plug cost items that do not have resources or are not resource driven. The cost categories have only a blanket cost category markup that helps drive the total revenue amount on the cost item.

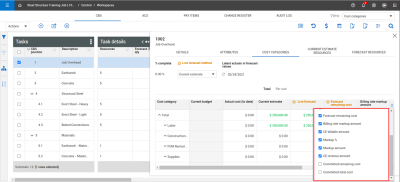

You can view this information from Markup columns such as Billing rate markup amount, CE billable amount, Markup amount, and CE revenue amount.

The following table shows markup column information in the Cost categories tab of the Cost item details slide out.

| Column | Formula |

|---|---|

| CE billable amount | Current estimate amount + your Billing rate markup amount = CE billable amount |

| Markup amount |

Markup percent x your current estimate = markup amount - The Billing rate markup amount for plug cost items is always set to zero because you can only have a billing rate on resources. When this is a detailed cost item, this will shows your billing rate markup amount for all those resources. |

| CE revenue amount |

CE billable amount + your Markup amount = CE revenue amount - The CE revenue amount is how much revenue a cost item can have. This is only applicable for cost plus pay items. You can apply markups on cost items, and they do not affect the revenue on those cost items. The markups affect the revenue for cost plus pay items and any cost items that are assigned to cost plus pay items. |

For more information, see Markup percent.