Job Markup (Profit)

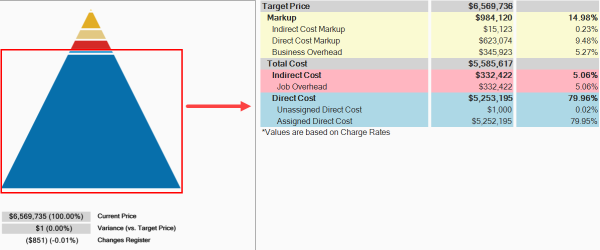

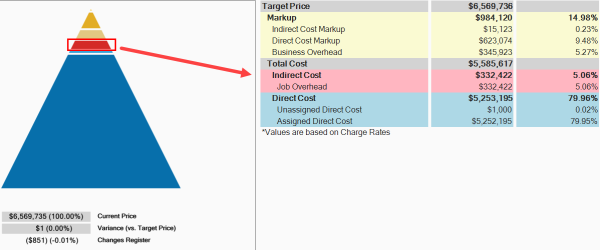

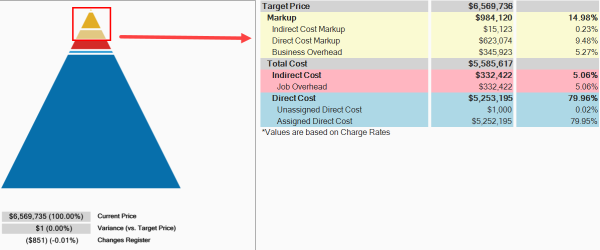

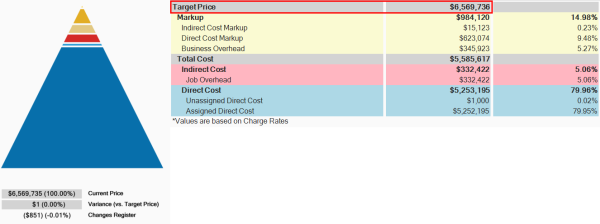

On the Data Map  notice how the different segments within the pyramid coincide with the percentage amounts that make up Direct Costs, Indirect Costs and Target Profit. Illustrations below show how the Data Map values correspond to the values that make up the cost and profit.

notice how the different segments within the pyramid coincide with the percentage amounts that make up Direct Costs, Indirect Costs and Target Profit. Illustrations below show how the Data Map values correspond to the values that make up the cost and profit.

To open the Data Map, select the Price tab, then Data Map from the Overhead and Profit section.

Target Price

For contractors building the price of your project is like building a pyramid. The foundation of your price consists of the direct costs of the job.

The images below represent a default examples.

On top of your direct costs, you can decide if costs with a cost segment of business overhead should be indirect costs or markup. You estimate your direct and indirect costs in the CBS Register.

At the top of the pyramid you add an amount for profit. You add profit in the Price Breakdown Structure (PBS) form. There is a very small block at the top of the Data Map, which comprises 0.22% of Indirect Cost Markup.

The total of the direct cost, indirect cost, and profit in the project is referred to in InEight Estimate as the Target Price. This is the final price that you want to submit as your proposal.

Price Breakdown Structure

As you already practiced, your direct and indirect costs are estimated in the CBS. Your project’s profit needs to be defined in the Price Breakdown Structure (PBS) form.

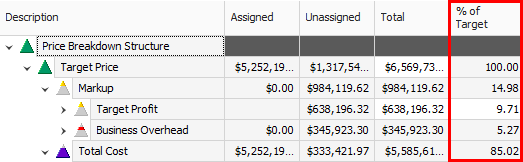

The main purpose of the Price Breakdown Structure (PBS) is to add markup (profit) to the estimate. The Price Breakdown Structure is a visual run-down of the costs and profit that make up your Target Price. It helps you analyze how your costs contribute to the price you are targeting, including the amount of profit you would like to include.

You can open the PBS from the InEight Estimate landing page by selecting the Price tab, then Price Breakdown Structure (PBS) from the Overhead and Profit section.

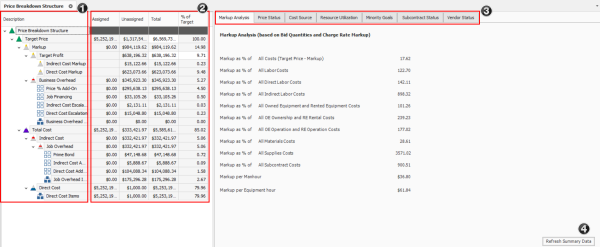

|

Name |

Definition |

|

|---|---|---|

|

1 |

PBS Description |

The left side of the screen displays several cost classifications:

|

|

2 |

Various Columns |

The Assigned and Unassigned columns show which costs are either assigned or not assigned to pay items. Unassigned costs are spread back to pay items based on the distribution logic set in Job Properties > Pricing. The Total columns represents a summation of both columns. Each layer displays with an amount, and the percentage of the Target Price that this amount represents. |

|

3 |

PBS Menu |

The right side of the screen holds several tabbed pages of information. This information is useful in analyzing the job at a summary level. |

|

4 |

Refresh Data |

To ensure that you are always reviewing the most up-to-date factors and ratios, click the Refresh Summary Data button whenever you are reviewing the data. |

All costs in the Price Breakdown Structure are based on pay quantities (not forecast take-off quantities).

Markup vs. Margin

Let’s look at the difference between Markup and Margin.

-

Markup is a function of cost, while margin is a function of price

-

Markup indicates how much you are marking up the cost

-

Margin indicates what percentage of your price the markup represents

The percentages on the main PBS screen are margin, so you can see what percentage each category in the PBS represents compared to the total price. If you enter 10% in the Target Profit field, your profit will be 10% margin of your total price.

When you open the Direct or Indirect Markup Records, the Rate percentage there indicates markup of the cost. If you enter 10% markup on $100, the markup will be $10.

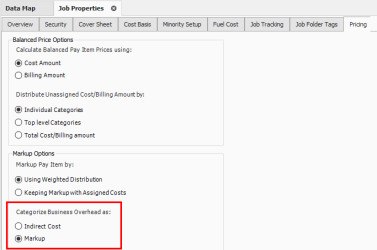

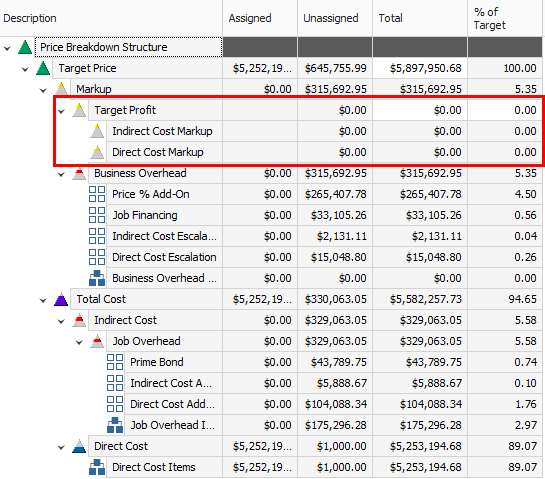

Within Job Properties, you can choose if costs with a cost segment of business overhead should be indirect costs or markup. If selecting markup, then Business Overhead will be spread within the Markup category of the Price Breakdown Structure. The Total Markup will be the sum of Target Profit and all Items categorized as Business Overhead.

This lets you see the true total cost of the job, including the total markup inclusive of the business overhead. You can also create cost items and categorize them as business overhead, then possibly include overhead costs such as estimating or home office expenses. This provides you with added flexibility in marking up your job.

Define Profit

Before you define profit, review the PBS. You estimated your direct cost items, and you also estimated some indirect cost items in the CBS. You can view your direct and indirect cost totals on the Price Breakdown Structure. Notice you have not defined profit yet.

You can define profit by entering a profit percentage directly on the PBS, or by modifying the Direct or Indirect Cost Markup Records.

The following steps walk you through plugging a Target Profit percentage directly on the PBS form.

Profit as a Percentage of Target Price

Step by Step — Add profit as a percentage of target price

-

Open your job.

-

Select the Price tab.

-

Select Price Breakdown Structure (PBS) from the Overhead and Profit section.

-

On the Target Profit row, enter a numeric value in the % of Target Price column; press Tab.

-

For this example, we’ll add 10% for the Target Profit.

Profit Through Direct Cost Markup Record

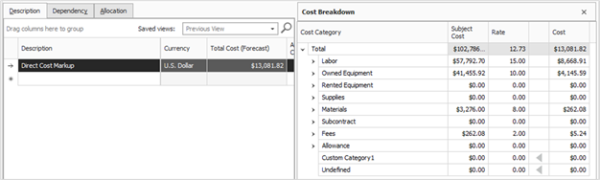

The following steps walk you through how to add profit as markup on the Direct Cost Markup record.

Step by Step — Modify the direct cost markup record

-

On the PBS form, double-click on the Direct Cost Markup row.

-

In the record, overwrite the Default entry with Direct Cost Markup in the description field.

-

In the Rate column on the Dependency Cost Breakdown, add a numeric value in Labor, Owned Equipment, Materials and Fees categories. Then reset other categories back to 0.

-

Click Ok to save your changes and return to the PBS.

-

Click the Refresh Summary Data button to see the changes reflected.