Dependent Cost Item Allocation

Step by Step — Dependent Cost Item Allocation

- From the CBS Register, right click on the first cost item and select Insert Dependent Cost Item from the context menu.

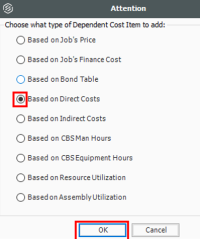

- When the Attention dialog box shows, select Based on Direct Costs. Once done, click OK.

- Find your new cost item. Then double click to open the cost item record.

- In the CBS Position Code Description, enter the description Small Tools & Supplies.

- Enter in the cost item, “ST&S”.

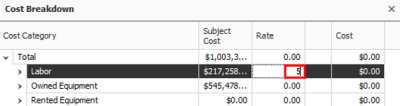

- In the Cost Breakdown default data block, set the labor rate as 5%.

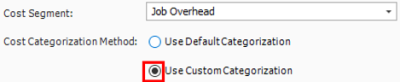

- In the Cost Item Record, select the Cost Categorization tab.

- Under the Cost Categorization Method, select the Use Custom Categorization radio button.

- Find the Supplies Cost Category and check the box next to Supplies.

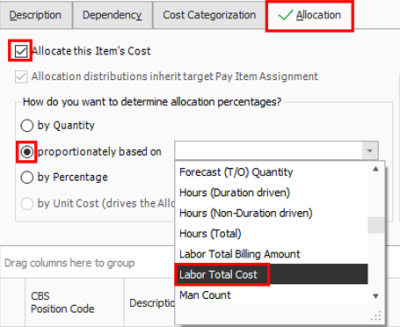

- Select the Allocation tab. Then, check the box for Allocate this Item’s Cost.

- Select the proportionately based on radio button. From the drop down, select Labor Total Cost.

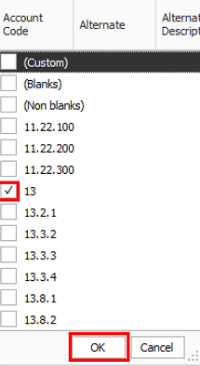

- In the Cost Item Record, filter the Account Code column to 13. Once you are done selecting the filter, click OK.

- In the Cost Item Record, check the Include box in the Include column for every cost item.

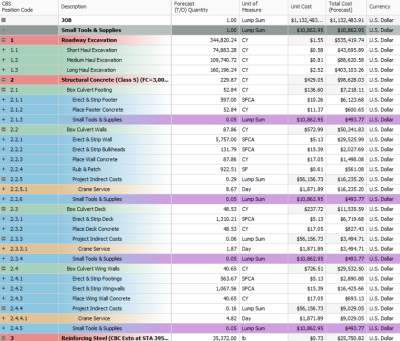

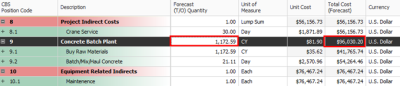

- Return to the CBS Register. The ST&S is distributed to all of the selected cost items.

Turning Off Cost Allocation

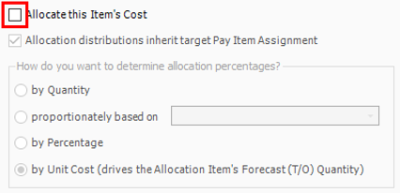

If you determine that you no longer want to spread the cost of an Allocation Item, you can turn off cost allocation for that cost item. The logic that you created to spread the costs are retained, so you can easily turn it back on later.

Distributions cannot exist in the CBS when a job is published for Job Tracking. To remove Distributions, either break the Cost Allocation link or uncheck the Allocate this Item’s Cost check box on the Cost Item Record - Allocation tab.

Step by Step — Turning Off Cost Allocation

- From the CBS Register, select the Concrete Batch Plant Cost Item Record.

- From the Ribbon, select the Actions tab. Under the Edit section, select Open. The Cost Item Record opens.

- Select the Allocation tab. Uncheck the box for Allocate this Item’s Cost.

- Once done, click OK to return to the CBS Register.

- All of the distribution cost items are gone, but the quantity and the total cost of the Concrete Batch Plant has not changed.

Breaking a Cost Allocation Link

To make a Distribution a permanent part of the CBS, and permit its costs and quantities to be directly editable under the cost item(s) to which it has been distributed, break the Cost Allocation link.

Step by Step — Breaking a Cost Allocation Link

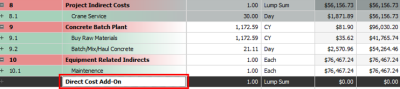

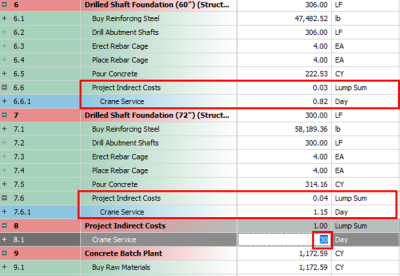

- From the CBS Register, select the Project Indirect Costs Cost Item Record.

- From the Ribbon, select the Actions tab. Under the Edit section, select Open. The Cost Item Record opens.

- Select the Allocation tab. Then go to the CBS Register in the record.

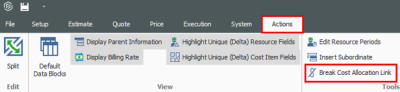

- Select the cost item with a Cost Allocation Link. Then from the Ribbon, select the Actions tab.

- Under Tools, select Break Cost Allocation Link.

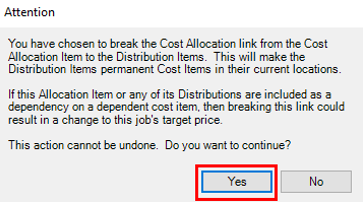

- When the Attention dialog box shows, click Yes to continue.

- The original cost item still exists and is now becomes editable. All the distribution cost items are now editable as well. They are now permanent items and are no longer highlighted in purple either.

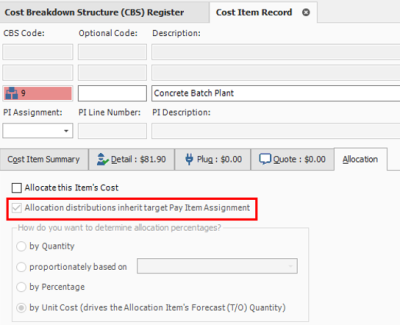

Pay Item Assignment for Allocation Distribution in an Unlocked Job

In the Cost Item Record - Allocation tab, the check box Allocation distributions inherit target Pay Item Assignment was added. When the check box is selected in an unlocked job, the system uses the same allocation distribution for the cost item’s costs anytime the cost item is copied and added to a job. For a locked job, this is the normal system behavior. This option is always selected and cannot be edited.