Another phrase for the Cost plus billing method is Time and Material or Time and Expenses. Instead of having a contractual agreement of being paid a certain lump sum, you are reimbursed for your time, labor, and equipment hours and any materials that you purchased as well. With Cost plus, a markup value is typically included. You submit time cards each week to get paid for your labor hours, equipment hours, and any materials or supplies that you purchased plus any markup value that had been agreed upon.

The Cost plus Revenue Forecast Methods are only applicable to pay items that have a billing method of Cost plus. These forecast methods include:

- Billed

- Earned

- Manual

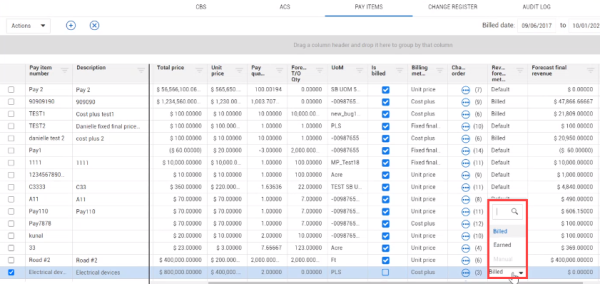

The following image and table show details for the revenue forecast methods.

| Forecast method | Description |

|---|---|

| Billed | All of your forecast remaining revenue that is driven off your cost items. Meaning this method's calculation is the following: 1 - % complete x Work Hours x Billing Rate. This gives you your Forecast Remaining revenue which is your Remaining revenue you need to earn on the cost item. For the pay item, the revenue sums up all of those remaining revenues at the cost item level. It then adds anything that has been billed which is the Remaining revenue at the cost item level plus any revenue that has been billed to the pay item. |

| Earned | Similar to the Billed Revenue except it uses the Forecast remaining revenue. The Earned Revenue calculation is your forecast remaining revenue at the cost item level summed up for all the cost items assigned to that pay item plus your earned revenue. The earned revenue is also driven by the cost items. To summarize, it is the forecast remaining revenue plus anything that you earned. This is also the calculation for your percent complete as well. |

| Manual | manually forecasts your final revenue on that pay item with you entering in a value. |